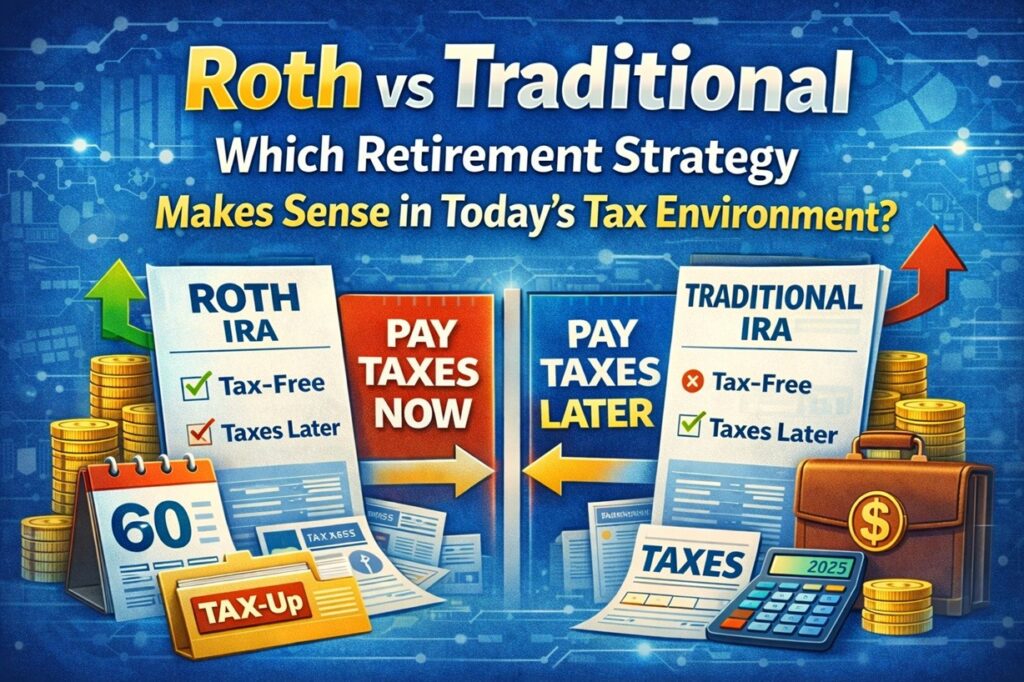

Roth vs. Traditional: Which Retirement Strategy Makes Sense in Today’s Tax Environment?

Choosing between Roth and Traditional retirement accounts has become one of the most important — and confusing — financial decisions facing today’s investors. With evolving tax laws, higher government debt, and longer retirements, the “right” choice is no longer one-size-fits-all. Understanding how each strategy works can help you reduce taxes, improve flexibility, and create more […]

Should You Still Contribute to a 401(k) After Age 60?

As retirement approaches, many people begin asking an important question: Does it still make sense to contribute to a 401(k) after age 60? The short answer: for many people, yes — but it depends on your income, tax situation, and retirement timeline. With updated retirement laws, higher catch-up limits, and longer life expectancies, contributing later […]

Navigating the Timeline: How Long Does It Take to Roll Over Your 401(k) into an IRA?

If you’re considering rolling over your 401(k) into an Individual Retirement Account (IRA), you may be wondering: How long does the process typically take? Let’s delve into the factors that influence the timeline for a rollover and why consulting a financial advisor can expedite the transition while ensuring a smooth experience. Factors Influencing the Timeline […]

Timing Your 401(k) to IRA Conversion: A Comprehensive Guide

Are you pondering the optimal timing for converting your 401(k) to an Individual Retirement Account (IRA)? It’s a significant decision that can impact your retirement savings and financial future. Let’s delve into the factors to consider when contemplating this transition and why seeking guidance from a financial advisor is invaluable. Factors to Consider Several factors […]

Demystifying the 60-Day Rule: A Guide to Rollovers and Your 401(k)

If you’re considering rolling over your 401(k) into another retirement account, you may have encountered the term “60-day rule.” But what exactly does it mean, and how does it impact your rollover decisions? Let’s delve into this important aspect of retirement planning and explore why seeking guidance from a financial advisor is essential. Understanding the […]

Understanding the Costs of Transferring Your 401(k) to an IRA: A Comprehensive Guide

Are you considering transferring your 401(k) to an Individual Retirement Account (IRA), but concerned about the potential costs involved? It’s a common query among individuals planning for their retirement. Understanding the expenses associated with this transition is crucial for making informed decisions about your financial future. Do I Have to Pay to Transfer My 401(k) […]

Maximizing Your Retirement Strategy: Rolling Your 401(k) into an IRA While Still Employed

Many individuals wonder whether it’s possible to roll their 401(k) into an IRA while still employed. This strategic move can offer greater flexibility, control, and investment options. In this article, we’ll explore the process and benefits of rolling your 401(k) into an IRA while still employed, with insights from a financial advisor to help you […]

Navigating Financial Crossroads: Is Cashing Out Your 401(k) After Leaving a Job a Wise Move?

Leaving a job often prompts individuals to reassess their financial strategies, and one common question that arises is whether it’s smart to cash out a 401(k). In this article, we’ll delve into the considerations, advantages, and drawbacks of cashing out your 401(k) after leaving a job, providing valuable insights from a financial advisor to help […]

Navigating Your 401(k) After Leaving a Job: Timely Insights for a Secure Financial Future

Leaving a job comes with a myriad of decisions, and one crucial aspect is managing your retirement funds, particularly your 401(k). In this guide, we’ll explore the timeline for cashing out your 401(k) after leaving a job, providing insights from a financial advisor to ensure you make informed choices for your financial future. Understanding the […]

Unlocking Your Financial Future: Choosing the Best Destination for Your 401(k) Roll Over

In the realm of financial planning, one crucial decision many individuals face is what to do with their 401(k) when transitioning jobs or entering retirement. As you stand at the crossroads of potential investment opportunities, it’s essential to make informed choices that align with your long-term financial goals. In this guide, we’ll explore the best […]